How to conduct an effective AP audit

Corcentric

The critical steps for a comprehensive, compliant accounts payable auditing process

Let’s begin by understanding accounts payable (AP) in today’s context: it’s not just the amount a company owes for goods or services received but also includes digital transactions and other modern forms of payment.

In the era of digital transformation, an AP audit transcends traditional financial due diligence. By harnessing the capabilities of AI-driven auditing methods, companies can ensure that ledger transactions align seamlessly with general ledger entries and payable records. This not only mitigates fraud risks but also leverages predictive analytics to pinpoint potential discrepancies, setting a new standard for accuracy and efficiency in the auditing landscape. Periodic AP audits are standard practice to review and ensure procurement invoices, statements, liabilities, and other expenses have been recorded correctly using an accounting software program or manual methods and are accurately reflected in year-end financial statements.

Given the substantial financial transactions being processed by the AP department, it’s imperative for organizations to ensure meticulous and accurate audits.

What is an AP audit?

AP auditing is the process of reviewing all the related financial information that resides on a company’s AP records in detail. The actual AP audit is generally performed by an independent firm in order to provide an objective assessment of how accurately and comprehensively AP invoices and other transactions reflect actual business operations.

In other words, are AP transactions faithfully and fully recorded, and do financial statements, the balance sheet, and the general ledger all tally?

The AICPA (American Institute of Certified Public Accountants) delineates audit standards, drawing guidance from the Auditing Standards Board (ASB), ensuring comprehensive and standardized audit practices. Based on their criteria around auditing, attestation, and quality control, auditors look for veracity in AP records with a focus on potential fraud, risk, malfeasance, and any general mistakes.

AP departments should think of audits as an opportunity to inspect and uncover any issues or problems before they become serious.

The importance of auditing AP on a regular basis

As mentioned, it’s important for AP to ensure transaction recording is complete and valid, and auditing represents an opportunity to verify and rectify those records. Here’s why it’s critical to complete audits on a regular basis:

- With the rise of digital transactions and automated accounting systems, ensuring the accuracy of period-end payables has become even more crucial to prevent unintentional errors or manipulations

- It is an opportunity to search for unrecorded liabilities in period-end AP details

- Many types of theft can occur in AP – regular audits mitigate the possibilities of fraud, duplicate payments, illegitimate payments, and related risks

- Companies need to authenticate complete recorded AP against related purchase transactions and invoices

- It is a time to evaluate internal control procedures, AP transactions and financial statements for accuracy, and ensure compliance with laws, regulatory policies (such as Sarbanes-Oxley), industry standards, and other guidelines

- Establish audit procedures to respond to weak or non-existent controls

Best AP audit procedures

Following the best AP audit procedures, whether a business is large or small, it is critical to show that the AP department has robust internal controls and is accurately depicting the year-end financial statement.

An effective AP audit procedure includes:

- Disclosure of all recorded transactions expenses, regardless of how big or small, including the year-end financial statement. This should include management’s review, verification, and approval of these statements as complete.

- Strict adherence to GAAP (Generally Accepted Accounting Principles) guidelines.

- A cross-check of every payment process transaction by contacting every vendor providing goods and/or services to verify transaction data during the period in question.

- Usage of cut-off tests to confirm that transaction dates and payments match and identify any unmatched documents.

Step-by-step process of an AP audit

The exact AP audit process is usually guided by factors including company size, corporate structure, geographical locations, etc. GAAP are not uniformly applied the same way across all states in the US, and depending on the location, there can be additional reporting requirements.

The objectives of an AP audit are to evaluate internal control processes, review and evaluate transactions for accuracy, and determine compliance with applicable laws, regulations, policies, and procedures. The audit trail is looking for validity and consistency in vendor invoices, bank records, and other records — as well as accounting procedures — to ensure that the AP balance provides full disclosure on year-end statements and that the company is presenting an accurate view of itself.

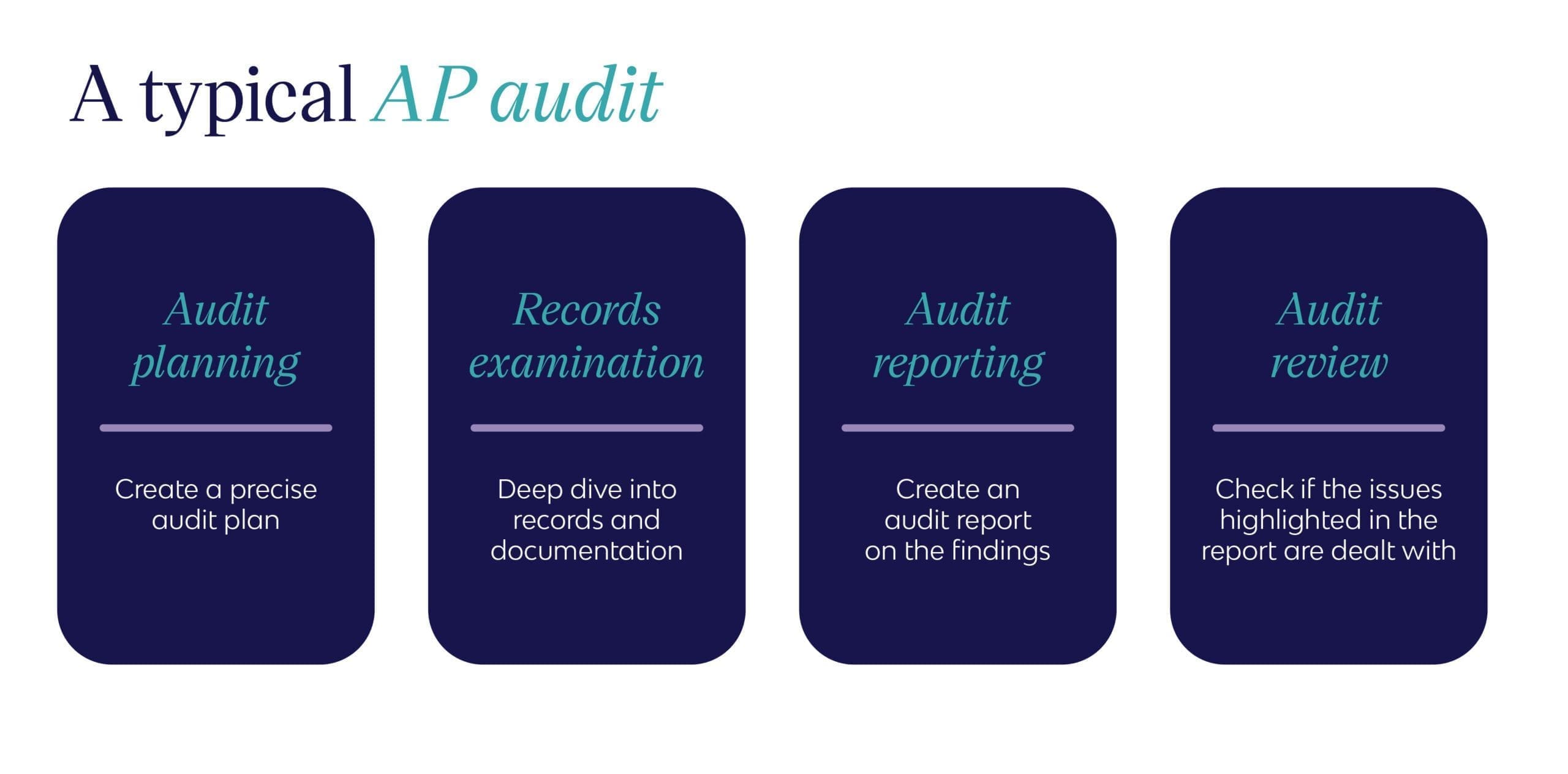

Here are the stages of a typical AP audit:

1. AP audit planning

When a company is notified that there will be an upcoming audit, the goals and parameters will be established with the auditor, who will create the precise AP audit plan.

2. AP records examination

The heavy lifting of an AP audit is when the auditing team deep dives into AP records and documentation. Depending on company size, this can last a few days or a few weeks, after which an audit report will be generated that compiles and analyzes the research.

3. AP audit reporting

Based on the AP auditor’s findings, an audit report is created. The report provides a summary, details the areas examined and processes involved, provides feedback and guidelines, and highlights any immediate concerns.

4. AP audit review

An AP audit and report aren’t the end of the audit process but just the initial stage. Based on the auditor’s findings, there will be a follow-up to determine that highlighted issues and concerns have been dealt with and the company has achieved satisfactory results.

Planning for your AP audit

As we mentioned, an AP audit is an opportunity to ensure your recorded transactions, invoices, purchase orders (PO), and other documents and practices are in good order – regular internal audits will reveal this. It’s time to be organized, not time to panic.

The AP team and senior management should have a plan for what they want the audit to achieve, ensure the standard operating procedures (SOPs) are in place and being followed, identify any potential fraud, and discuss areas for implementing improvements.

Documents needed

Here is a broad selection of documents that auditors will look for in an AP audit that teams need to have prepared:

- An internal controls review related to AP

- A comparative budget-to-actual expense reports with detailed analysis and explanations of any deviations or variances

- AP and expenses risk assessment

- A detailed period-end AP ledger

- Overview of accounts payable and expense audit procedures

- A report documenting any deficiencies in AP and expense controls

- Documentation detailing unrecorded liabilities

- Documentation about any fraud investigation related to controls absence or weaknesses (such as lack of segregation of duties)

Access to records

Easy access to payable records is crucial for a seamless, comprehensive audit process. With the integration of AI-driven AP automation, e-invoicing, and electronic payments, the audit preparation and completion become significantly more efficient, reducing human errors and enhancing accuracy.

Adopting AP automation software streamlines the auditing process, making it more cost-effective as records are readily accessible.

Simplifying and accelerating access to records for auditors – invoices, POs, and supplier lists (including new vendors) – will ensure the accuracy of the audit and the completeness of the resulting report. The time saving from AP automation can also translate into cost savings since the automated process takes less time than a paper-based AP process.

What to look for in an AP audit?

The specifics of an AP audit depend on a number of factors, including business size, industry, location, and depth of audit intent. AP auditors will monitor and flag any unusual transactions uncovered, as well as identify any fraud detection (many auditors have Association of Certified Fraud Examiners (ACFE) credentials). Generally speaking, there are four areas that an AP audit will be looking for:

Completeness

Auditing for completeness is the process of verifying payable balances against general ledger balances – that they are “complete” based on real payable journal entries, purchase orders, and invoices. This is the most critical stage of the AP auditing process, and auditors will be looking for an audit trail that matches payments to recorded payables, including electronic payments, (auditors generally use cutoff tests to determine timeliness) as well as open records with unmatched documents.

Compliance

An AP audit will determine whether a company’s AP process adheres to the strictures of GAAP practices. Compliance demands that GAAP procedures are followed, which includes reviewing a company’s audit trail in detail at a transaction level to confirm the right accounting methods are used. The auditors will look at the full range of financial documents, including period-end financial statements, balance sheets, and cash flow and income statements, tracing general ledger entries backward to follow the precise transaction path.

Validity

When auditors look for “validity,” it means they are checking the legitimacy of AP transactions. This usually entails contacting third-party suppliers and vendors for specific transaction confirmations. While commonly used third parties are most often the ones contacted, auditors will use their discretion around which suppliers are contacted.

Accuracy

Obviously, the accuracy of a company’s financial records is critical, and an AP audit will look to confirm the accuracy of the AP practices. Auditors will perform several procedures at this stage, including examining the SOP, and recalculation of supplier invoices and payments.

How often should you conduct an AP audit?

There is no strict schedule for how often a business should conduct the AP auditing process, but typically a company will go through a process of AP auditing to review year-end financial reporting. An audit may also happen more frequently depending on the size and complexity of the organization, or if it has undergone significant changes, such as adopting new accounting software or auditing standards, or implemented an AP automation solution, ERP, and/or other financial tools.

The benefits of AP audit automation

Getting organized for an AP audit report can be time-consuming, stressful, and disruptive, but the results can have significant benefits: according to The Association of Certified Fraud Examiners risk assessment, the median loss to companies from financial statement fraud in 2020 was $954,000, with the largest percentage of cases – 14% – coming from the accounting department.

Being audit-ready is greatly simplified when an AP organization embraces digital transformation, especially by implementing and adopting AI-enhanced AP automation software solutions. These AI-driven solutions can predict anomalies, ensure compliance, and offer real-time insights. As software solutions become ever-increasingly capable (AI and machine learning will be taking a lead role before long), a technology-forward strategy not only simplifies and speeds the day-to-day AP process, it almost entirely removes the need for human inputs along the way.

AP audit automation:

- Eliminates costly, time-consuming manual data entry and improves accuracy

- Helps ensure greater compliance, fewer disputes, and elimination of duplicate tasks

- Standardizes and accelerates processes so they’re faster, and with fewer errors

- Gives your AP team complete visibility into invoices and POs in real time

- Integration with an existing ERP platform means greater data consistency

- Facilitates on-demand reporting capabilities so you are always audit-ready

Avoiding human error

A significant portion of the issues identified during the AP audit process, whether intentional or accidental, arise from human errors. Challenges like misstatements, duplicate payments, overpayments, and errors in check register maintenance, including potential fraud, can be drastically reduced or even eradicated with AI-powered AP automation. AI algorithms can detect patterns, flag inconsistencies, and provide predictive analytics to prevent such errors.

While the digitization of AP offers unparalleled efficiency, agility, and speed, the introduction of AI in AP audits elevates the accuracy of the entire process. AI-driven automation not only streamlines tasks but also ensures precision, consistency, and proactive error detection. As detailed in the steps above, audits are looking for compliance, completeness, accuracy, and validity. AP automation can achieve these consistently and quickly, avoiding human error by avoiding human inputs.

Automating AP auditing for compliance

With the evolution of AP automation, businesses are not just leveraging technology but also incorporating data analytics, real-time monitoring, and predictive analysis into their operations. This shift from paper-based systems to dynamic, cloud-based platforms ensures unparalleled process visibility, making AP auditing more efficient and insightful.

The digital advantage of automation across all stages, from purchase orders (PO) to invoicing, approvals, three-way matching, and payments, helps AP teams ensure compliance through transparency, aiding finance and bookkeeping in adhering to GAAP standards. This not only creates a more fluid AP process —while optimizing cash flow — it takes the angst out of AP audit preparation and reporting. Consider these benefits of automating accounts payable:

- It allows you to process invoices up to 70% faster

- Reduces invoice processing costs by up to 80%

- Can handle 100% of payment disbursements

- Enables AP departments to scale for growth without increasing headcount

- Improves supply chain visibility

- Frees up AP teams to focus on adding value

Ultimately, automation enables the kind of agility that empowers AP to play a much more strategic role in enterprise success. Regardless of your organization’s size, learn more about how AP automation from Corcentric can unleash more value by eliminating the inefficiency of paper invoices and manual processing and contact us today.