What is e-invoicing compliance and why is it so important?

E-invoicing compliance can be broadly defined as adhering to the legal standards and rules governing the sending and receiving of electronic invoices by suppliers and buyers. These regulations vary across different countries, with specific invoice content requirements established by local laws. The stipulated prerequisites depend on the jurisdiction under which an invoice is issued.

The 2023 EU Report on the VAT Gap highlights the challenges tax authorities confronted in ensuring optimal revenue collection. Across the globe, tax authorities are enacting measures to narrow this gap, with many nations presently contemplating their implementation. The EU Commission’s report on VAT in the Digital Age not only mapped out the favorable outcomes linked to the adoption of such measures but also put forth recommendations for the uniform integration of these approaches. Change is on the horizon – and whether it has already begun impacting your business or not, prioritizing compliance with e-invoicing regulations is increasingly imperative.

Why is e-invoicing compliance so critical to my business?

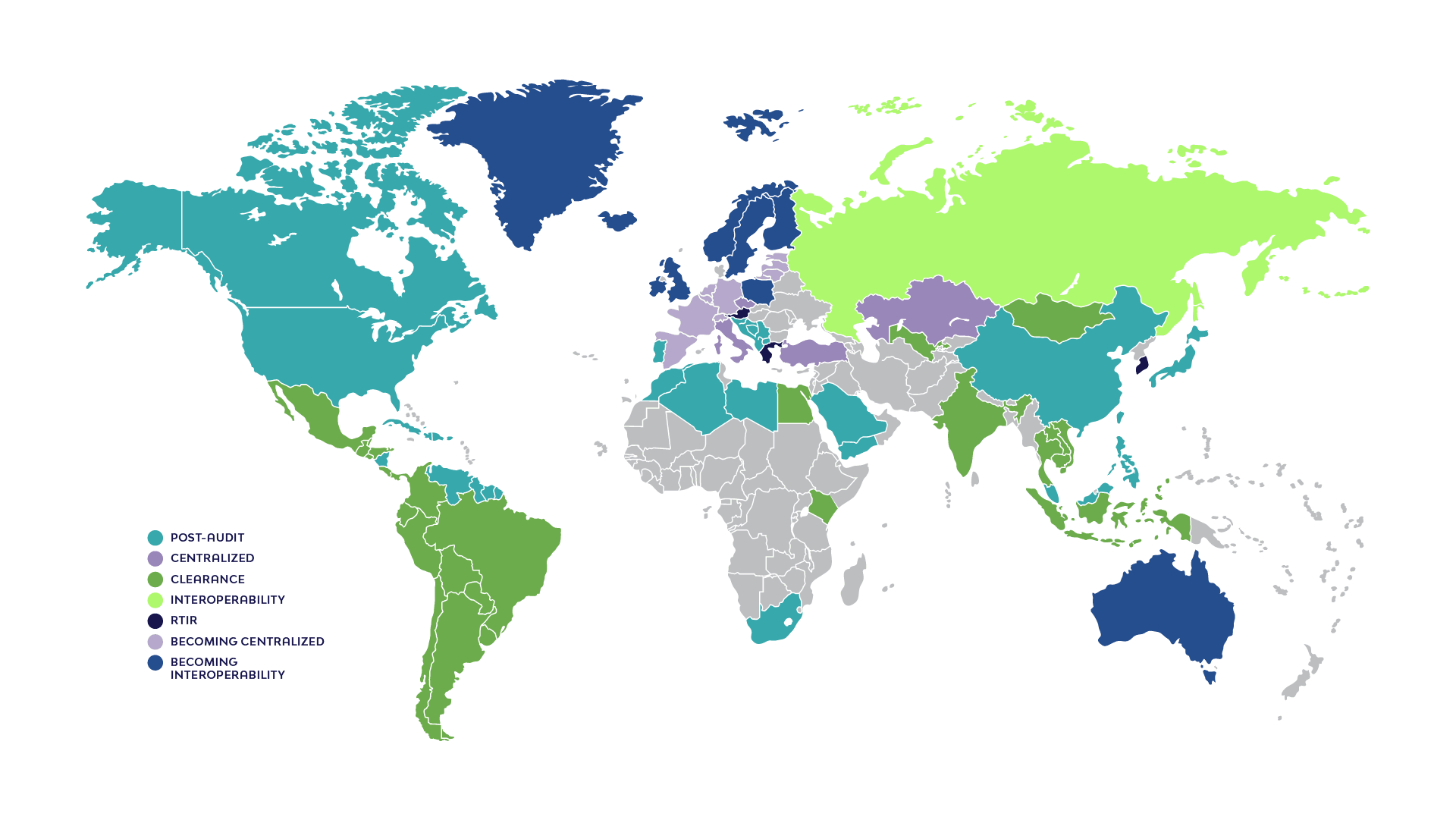

Changes to regulations and the introduction of government controls have made e-invoicing compliance a critical part of business. Government mandates for e-invoicing are rapidly expanding across the globe. While the mandates have much in common across countries, the process, requirements, and legalities are unique for each. For example, countries are implementing invoice models such as centralized, clearance, and interoperability. This creates a highly complex tapestry requiring a specialist to manage.

*Please note, specific country compliance regulations may change periodically.

Corcentric emphasizes the importance of aligning your goals and strategies. More than ever, companies are finding themselves conducting global trade on a larger scale. Although this is contributing to the growth of your company, the complications of global business are following. Remaining compliant across international borders is not only challenging, but also time-consuming. The majority of these countries’ regulations are occurring this year, making this a critical initiative for your business.

How will e-invoicing compliance impact my business?

The small list of e-invoicing compliance conditions may include some, or all, of the following:

- Local storage or use of local government-approved vendors

- Adherence to a rapidly growing list of different document formats for each country

- Written consent from recipients to receive invoices via EDI

- Periodic reporting requirements

- Use of hardware that is purchased from locally approved distributors

- Connections with mandatory governmental systems, i.e., a local platform and/or a global platform such as Peppol

- Accreditation from the local tax authority that proves you meet all technical requirements for issuance, exchange, receipt, and acceptance processes

With Corcentric, you can let go of your e-invoicing compliance worries with one partner, one point of integration, and one solution.

Datasheet: Simplify e-invoicing compliance

Ease your compliance worries

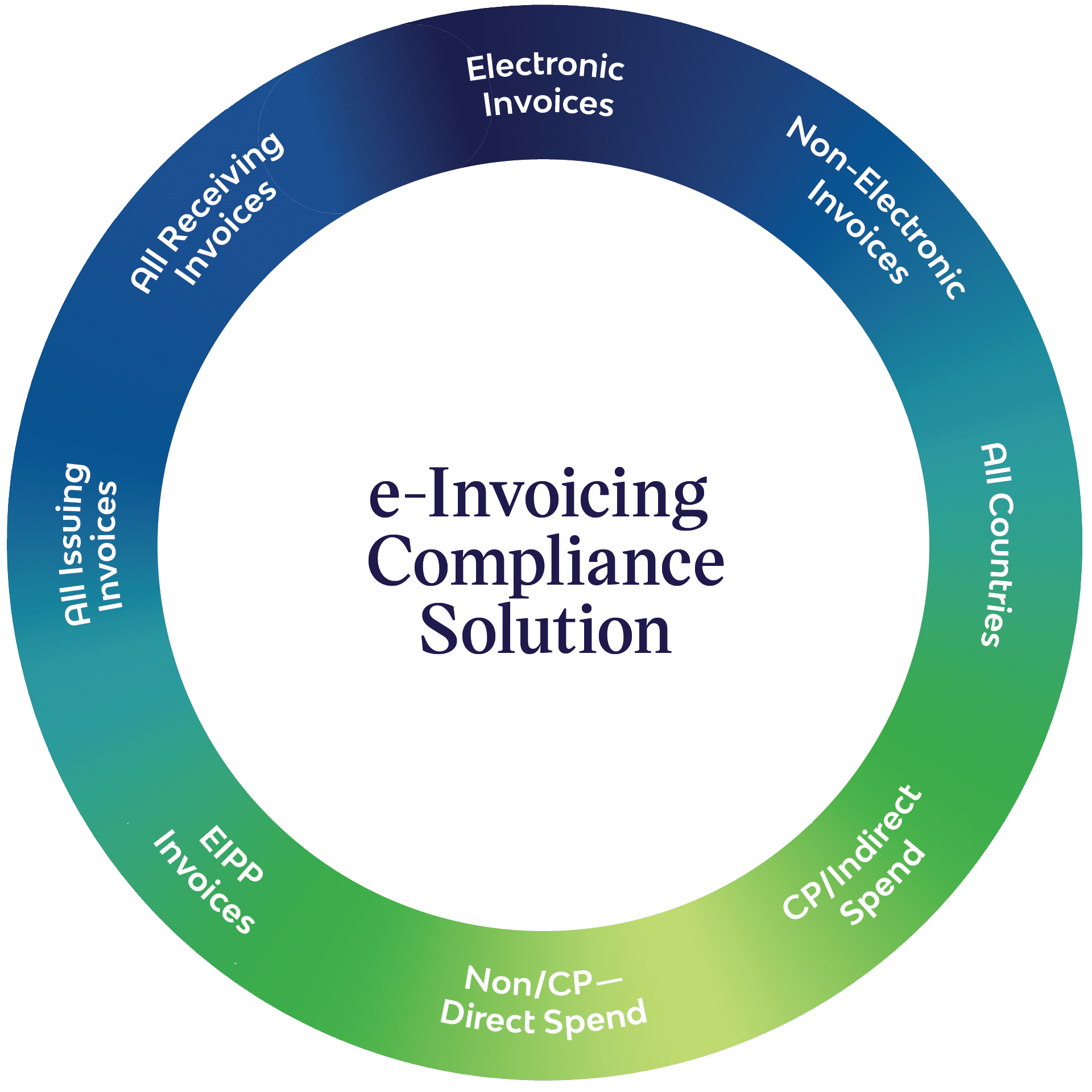

E-Invoicing compliance efforts involve the supplier, the buyer, and Corcentric as your service provider. Our e-Invoicing solution covers the entire process from Accounts Payable to Accounts Receivable, covering any document type, and provides the tools for you to achieve compliance within your business practices.

Ready to take the next step?