Feeling the uncertainty after AvidXchange’s acquisition?Switch to stability. Partner with confidence.

While AvidXchange is in transition, your payments process shouldn’t be. In today’s unstable market, Avid’s private equity ownership brings uncertainty—shifting priorities, cost-cutting, and risk to supplier relationships. This isn’t the time to roll the dice on service quality or data security. Your AP payments partner should offer more than just technology—it should deliver continuity, stability, and service you can count on. Corcentric is built for long-term partnership, not private equity flip cycles.The result? More revenue from every transaction, deeper supplier loyalty, and a stronger enterprise valuation.

Corcentric delivers total payment control—from day one

Your complete, end-to-end payment solution—so you can simplify operations, reduce costs, and unlock value at every step.

From virtual card to ACH—every payment method, fully covered

Speed up payments, reduce costs, and earn rebates with a flexible platform that supports virtual cards, ACH, checks, and traditional cards.

From onboarding to adoption—we handle suppliers for you

Accelerate supplier enrollment with expert-led onboarding that eliminates friction and drives engagement from the start.

From payment to proof—execution and reconciliation, seamlessly managed

Streamline your process with automated payment execution, real-time tracking, and built-in reconciliation.

From risk to resilience—your payments, fully protected

Rest easy with enterprise-grade compliance, advanced fraud detection, and audit-ready controls safeguarding every transaction.

From launch to long-term success—support that stays with you

Count on full-service, white-glove support from implementation through every phase of your payment journey.

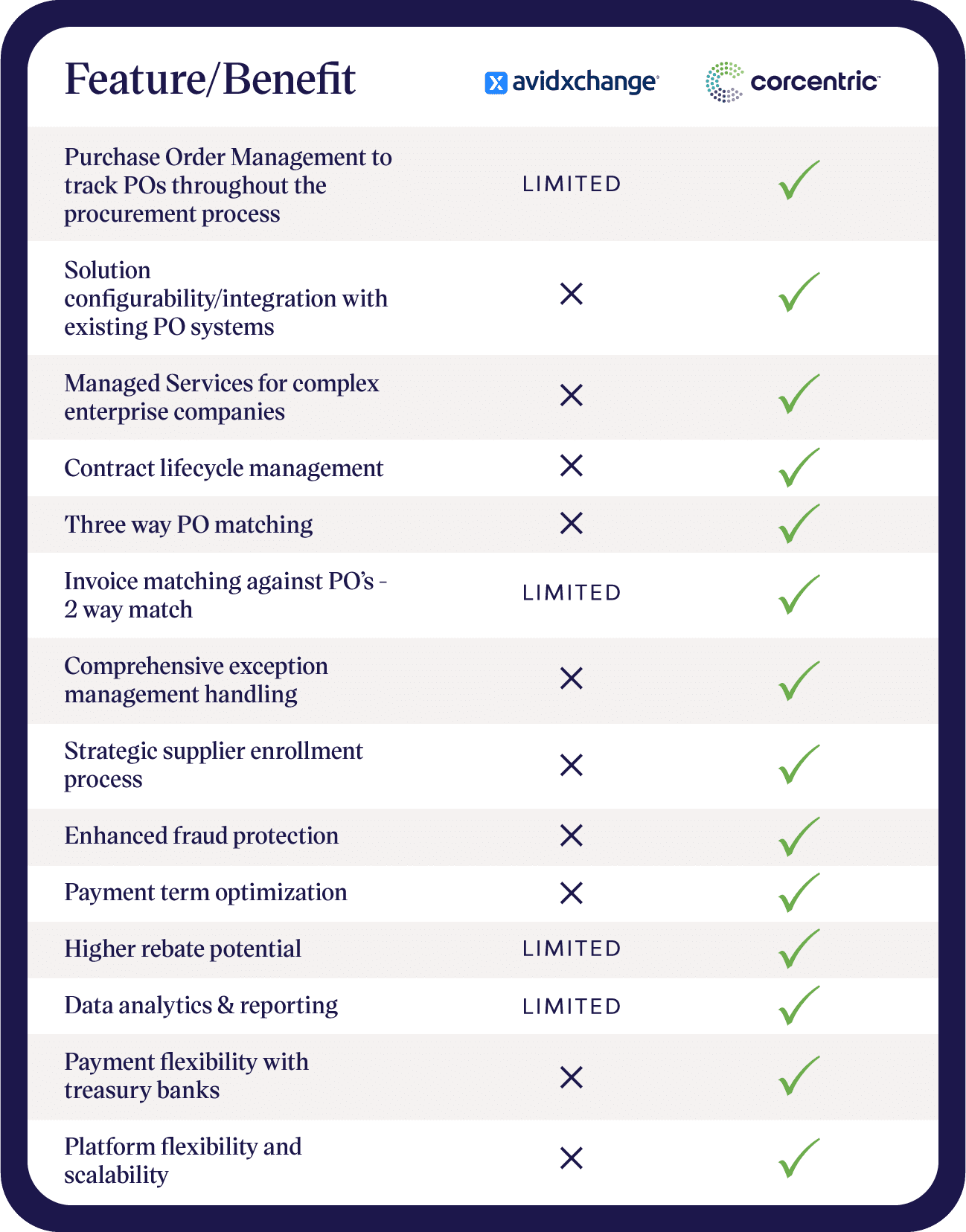

Why leading finance teams choose Corcentric

One partner. One platform. All payment types.

Consolidate and streamline your entire payments process through a single, secure platform—fully managed by Corcentric.

Trust built over two decades.

With 20+ years of experience, we’ve helped hundreds of organizations gain control, reduce risk, and unlock working capital—no disruption, no dilution of service.

A supplier experience they’ll thank you for.

From onboarding to ongoing support, we work with you to build a supplier strategy that drives adoption—without pressure tactics. No payment ultimatums. Just a coordinated, buyer-aligned approach that keeps suppliers happy and payments flowing smoothly.

Stability when others are in flux.

While others face uncertain futures, Corcentric remains financially sound and focused on long-term customer success.

Don’t let market instability disrupt your payments.

Whether you’re concerned about service continuity, supplier adoption, or technology fit, Corcentric offers the financial strength and operational stability your AP Payments function can depend on.